Africa Investment Exchange: Energy in Transition

27-28 April 2022, RSA House, London and online

Held under the Chatham House Rule, the meeting examined energy transition strategies and realities across Africa, including the availability of public and private sector climate finance, the future of gas and the prospects for hydrogen, carbon-capture, storage and alternative baseloads.

Africa’s passage to achieving sustained economic development, driven by clean energy and larger public and private financial flows, will blend the ever increasing use of renewable energies with new technologies. The intelligent use of resources is also under scrutiny. Many African leaders and analysts believe the energy transition must include a central role for natural gas for several decades to come.

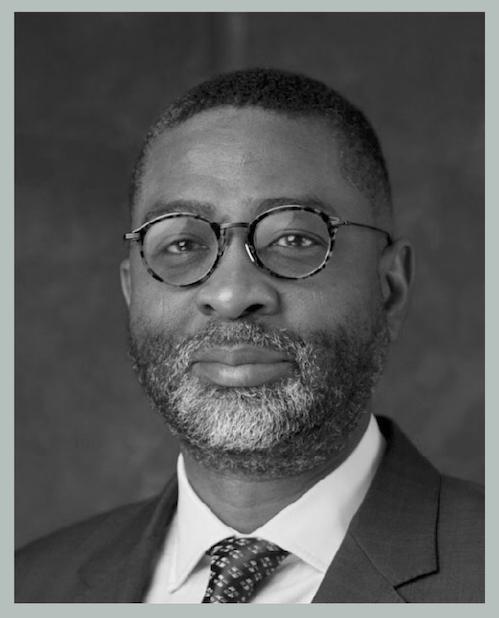

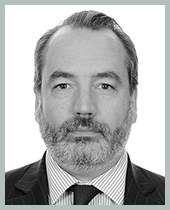

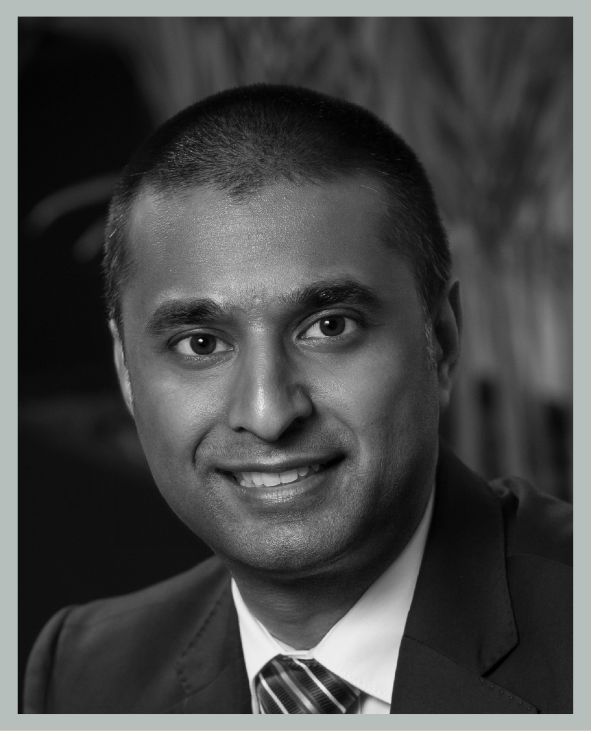

More than 40 confirmed panellists

See them all here or read their biogs below.

Meeting format

AIX: Energy in Transition is held under the Chatham House Rule which allows participants to break down the barriers by holding frank and open panel-led discussion without their identity or affiliation, nor that of any other participant, being revealed.

It is intended as a truly hybrid meeting, bringing delegates together at RSA House in London and via video links, but also by connecting gas professionals and investors with cleantech energy players, to discuss policy, projects and the most appropriate technologies and financing structures to accelerate Africa’s development and a just energy transition.

The Africa Investment Exchange is co-organised by Cross-border Information (CbI), and CbI’s African Energy, a consultancy that has been involved at the heart of the debate surrounding the development of the energy sector in Africa for more than 20 years.