20 October, 12.00-13.00 BST (GMT+1), online

From ESG to net-zero, corporate investors are increasingly looking for new routes to carbon friendly investments.

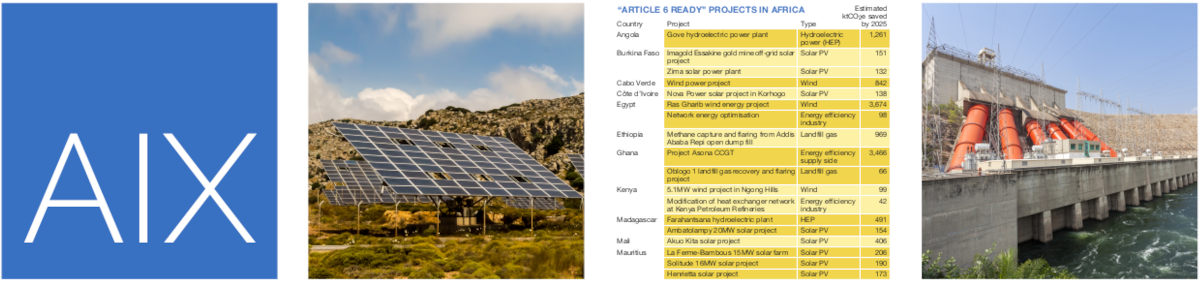

Global voluntary carbon and renewable credit markets made trades worth $1bn in 2021. This could grow even further as more of the private sector embrace climate friendly investing standards and project developers look to secure additional revenue sources. However, these markets are complex and often segmented, making it tricky for investors and project developers to navigate, especially those in Africa.

- How can investors buy carbon credits that are credible and how can project developers issue credits in a cost and resource effective way?

- How can markets be made liquid and credits more fungible?

- What impact could a new trading mechanism under the Paris Agreement have on voluntary credit markets?

This roundtable was chaired by African Energy’s Ajay Ubhi with contributions from guests including:

- Adriaan Korthius, Co-founder and managing partner, Climate Focus

- Bill Pazos, Managing director, AirCarbon Exchange

- Alexandre Dunod, Chief operating officer, Aera Group

- Chris Leeds, Head, Carbon Markets Development, Standard Chartered Bank

The meeting was free for all AIX members and African Energy subscribers

A recording of the roundtable is available to subscribers here

Become an AIX corporate member or African Energy susbcriber to gain easy access to AIX online meetings for your whole company.

Find out more here or contact Ricky Purnell for membership details.

AIX membership is free for independent Africa-based SMEs, utilities, regulators and public sector officials.