Africa Investment Exchange: Power and Renewables

Enabling power project development in Africa

14-15 November 2018, RSA House, London

Dates for next AIX: Power and Renewables at RSA House – 13 to 14 November 2019

Over the last five years AIX: Power & Renewables has become one of the meeting places of choice for Africa’s power sector stakeholders, including leading private and public sector investors, African officials and project developers.

Co-produced by consultants African Energy and held under the Chatham House Rule, proceedings are structured around panel-led discussions with the participating audience, with the main meeting limited to around 180 to preserve the networking environment.

The 2018 meeting was sponsored by Actis, AfIDA, DEG, Denham Capital, DLA Piper, ENGIE Africa, FMO, InfraCo Africa, Joule Africa, Lekela and Themis Energy.

It featured two main conference streams, additional break-out sessions and an evening reception and has been expanded to include additional side events:

• The third annual Off-grid Investment Exchange.

• AIX: Gas 2018 Update.

• AfricaHardball – a roundtable focused on political risks and governance issues that impact on projects and investment decisions.

• Launch of African Energy Data Book

Download the final agenda featuring more than 70 confirmed panellists

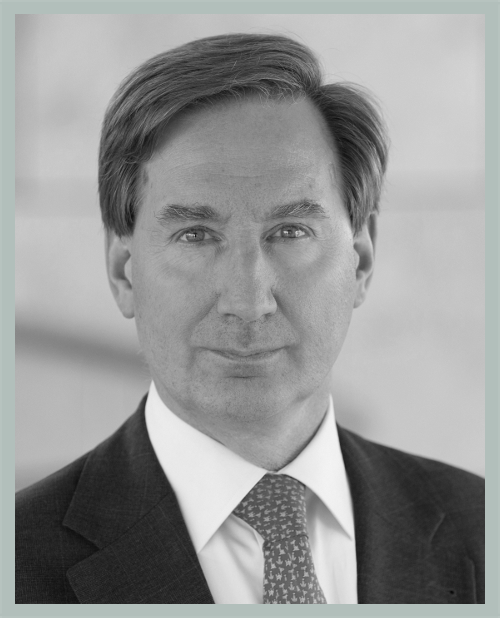

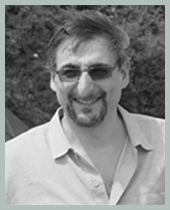

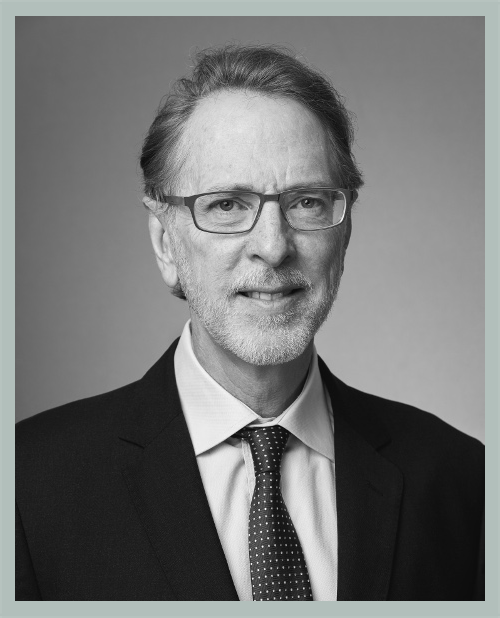

More than 70 panellists participated – including representatives from government departments, utilities and regulators across Africa. See below for details

Keep me updated on AIX: Power & Renewables and other AIX meetings.